IDENTIFYING THE SCHOOLS THAT WALL STREET RECRUITERS PREFER

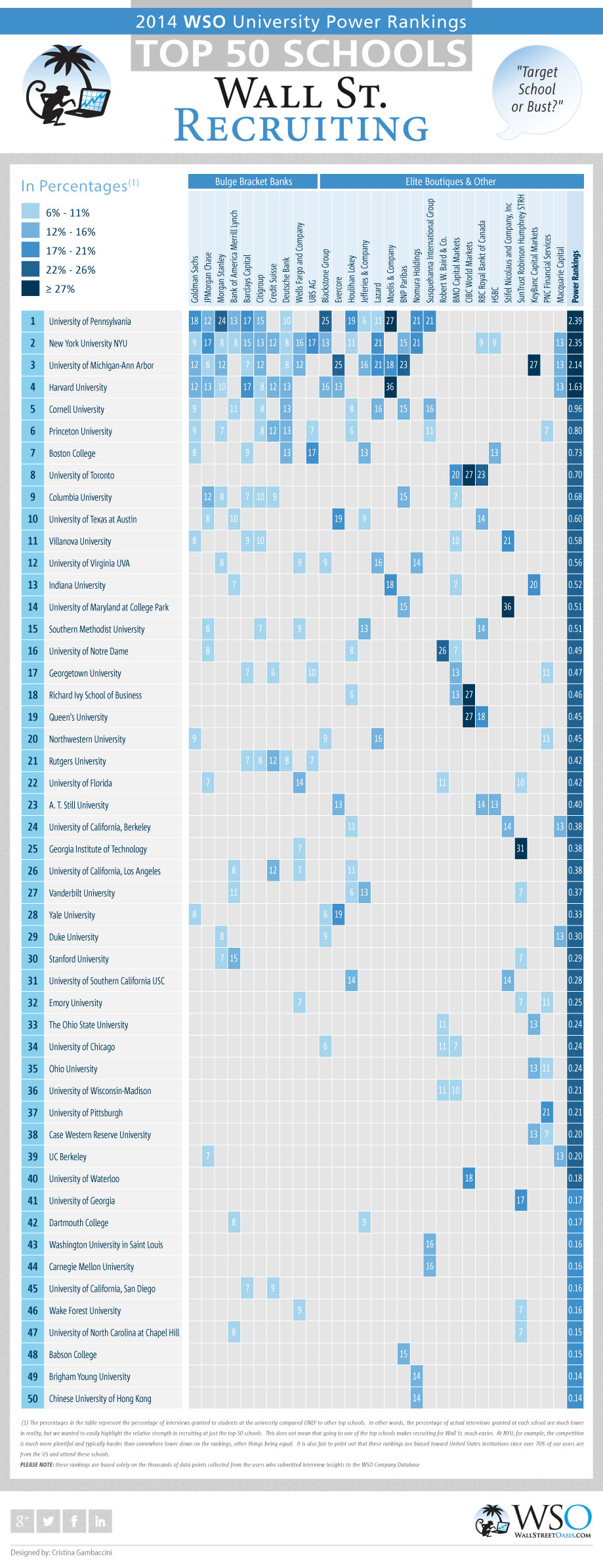

Here’s how the ranking worked. Wall Street Oasis began by cross referencing member interviews with member undergraduate programs. After segmenting interviews by employer, they compiled the number of interviews that each school had with 29 leading Wall Street firms. Wall Street Oasis could’ve listed the number of interviews that each school received with a particular firm. However, they decided to take it further, with the goal of showing each school’s relative strength across Wall Street. To do that, Wall Street Oasis compiled a list of the top 10 schools for each firm and based their ranking by percentage (within that top 10).

For example, at JP Morgan Chase, New York University received the highest percentage of interviews. 17% of the interviews among the top 10 schools involved NYU students. Wall Street Oasis also looked at school performance across the 29 top firms to formulate a “Power Ranking” score. To be considered for a top ten ranking (at a particular firm), a school must have produced three or more interviews with that firm.

Mind you, this data does come with some flaws. 23rd-ranked A.T. Still University is actually a default for members who don’t want to share their school. The University of California-Berkeley is ranked 24th and 39th, meaning it is likely a top 20 Wall Street program (and easily the biggest talent pipeline to Macquarie Capital). With 70% of Wall Street Oasis’ members hailing from the United States, the list lacks an international perspective (with #50 Chinese University of Hong Kong being the only non-Canadian international program on the list). What’s more, the ranking measures the entire school, not just the business program.

Still, the data is quite fresh, with 50% of Wall Street Oasis’ members joining after June 2013 (and 83% of submitting data after February 2011). Despite the limitations cited above, the ranking delivers a relatively reliable snapshot of where various firms are focusing their recruiting efforts. As expected, much of that effect is spent at the elite schools.

DO YOU HAVE A CHANCE TO GET IN?

Patrick Curtis, Wall Street Oasis’ Founder and “Chief Monkey,” concedes that attending certain schools has its advantages on Wall Street. “Going to a top undergraduate university makes breaking into investment banking significantly easier because of the streamlined process of on campus recruiting,” Curtis notes. “Students at these schools can drop their resume to 20+ banks that are visiting campus with a click of a button and expect to receive at least a handful of interviews if their resume is polished. Non-target students on the other hand, have to hustle much more just to get that first round interview, so they are at a distinct and significant disadvantage.”

However, Curtis adds that Wall Street isn’t closed to schools outside the top tier. “Over at Wall Street Oasis, we’ve consistently seen non-target students beat the odds by going above and beyond in their networking efforts and interview preparation. If you’re hungry enough and do enough leg work, the school you go to means much less to your chances. Once you’re in the interview room, what school you go to is much less relevant.”

To see how your school rates, check out Wall Street Oasis’ school power rankings below.

DON’T MISS: THE REAL SKINNY ON WALL STREET PAY

Source: Wall Street Oasis

Questions about this article? Email us or leave a comment below.