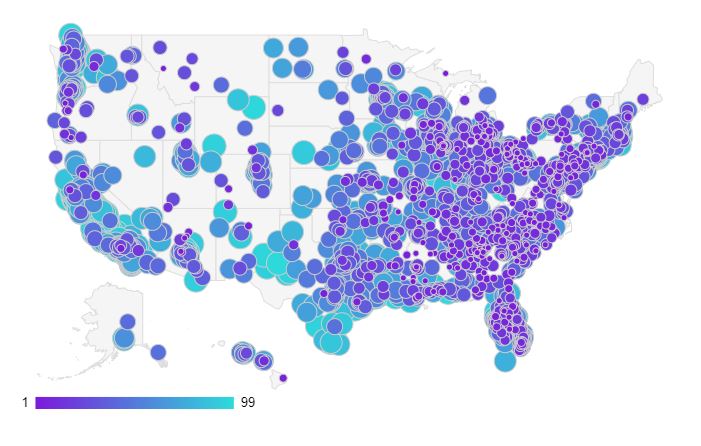

In this map of the United States generated by WalletHub, the turquois dots represent areas with the highest ratio of student debt to median income. The purple dots, located in areas that generally have higher incomes, represent cities with the lowest student debt ratio.

Student debt is one of the most hindersome financial burdens facing young (and not so young) Americans. In fact, the U.S. Supreme Court is weighing the $1.63 trillion dollar problem after hearing arguments in President Joe Biden’s federal student loan forgiveness program in February. The court will announce its decision by the end of June.

The average borrower now owes about $37,600. Some owe less, some owe a lot more. According to a new report by WalletHub, a personal finance platform, where a person lives can exacerbate the problem.

“High balances combined with a payoff timeline that lasts into middle age force many graduates to significantly delay or forego other financial goals such as saving for retirement or buying a home. Paying back student loans has also become even more difficult due to high inflation putting a strain on Americans’ finances,” WalletHub writes in its latest report, 2023’s Cities with the Most & Least Student Debt.

“While we have a big student-loan debt crisis as a country, student-loan debts are more unsustainable in some places than others.”

WALTERBORO, SC HAS THE HIGHEST STUDENT DEBT RATIO

The U.S. city with the highest ratio of student debt to median salary is Walterboro, S.C., at 82.44% While its median student debt is well below the national average at $25,747, its median salary for bachelor degree holders is just $31,230.

Following Walterboro is Spring Valley, N.Y., with a ratio of 78.62% and Brookhaven, Miss., at 77.91%

In fact, many of the cities with the highest student loan debt ratio are scattered among the south, as you can see in the chart below.

MCKEES ROCKS, PA, HAS THE LOWEST STUDENT DEBT RATIO

On the other end of the spectrum, McKees Rocks, Pa., has the lowest ratio of student debt to median income of bachelor’s degree holders at just 1.86%, though it appears to be a bit of an outlier. Its median student debt is $725 with a median income of $38,892.

The next lowest is Lafayette, Ind., at 11.16% and Los Altos, Calif., at 13.6%. Perhaps unsurprisingly, 16 of the lowest 30 student debt ratio cities in America are located in California, where median salaries tend to be much higher. See the table below for more detail.

WHAT STUDENTS SHOULD CONSIDER WHEN APPLYING FOR STUDENT LOANS

When considering whether to apply for student loans, and how much you will need, there are many factors to consider, says Robert Haywood Scott III, an economics professor at Leon Hess Business School at Monmouth University.

“Try to be realistic about what the total costs will be and figure out the monthly expenses. If those monthly expenses exceed what is reasonable for a new college graduate to afford, then maybe explore alternative funding options or start at a community college for a year or two before transferring,” Scott says in the report.

“First, community colleges are very inexpensive (if not free) for many students. Second, the two years of general education courses that community colleges offer will often transfer easily—something to discuss with the community college and the colleges you want to transfer to. Third, if you do well then there could be scholarship opportunities at the school you transfer to and you might have the chance to attend a better school than you would have out of high school.”

When financing your education, try to avoid private loans and credit card debt as much as possible, as those can get you into real trouble down the line, says Jonathan Burdick, ice Provost for Enrollment at Cornell University.

“For most other kinds of debt, and especially most student loans in which the government accepts the risk, you will have options to restructure the debt (such as income-based repayment) and reduce your expected payment to a manageable fraction of your income,” Burdick says.

“Take those options. The amount you have borrowed through federal student loans should never make you feel forced to take a higher-paying job you do not like or work two jobs.”

METHODOLOGY

For its report, WalletHub divided the median student-loan balance (based on TransUnion data from March 2023) by the median earnings of adults aged 25 and older with a bachelor’s degree in 2,519 U.S. cities.

It then assigned 100 points to the city with the highest ratio of student debt to earnings and 0 points to the city with the lowest.

DON’T MISS: THE P&Q INTERVIEW: IOWA TIPPIE DEAN AMY KRISTOF-BROWN ON THE FLEXIBLE, STACKABLE FUTURE OF BUSINESS EDUCATION AND IMPERIAL COLLEGE PREPARES FOR NEW DEGREE IN BIG DATA, FINANCE & ECON

Questions about this article? Email us or leave a comment below.