The Student Impact Fund Collaborative, the first of its kind in business schools, now boasts a membership of more than 400 students at 15 top business schools in four countries–and growing.

As the daughter of immigrants who arrived in the U.S. with virtually nothing, Neha Dalal attributes her career largely to the doors of opportunity others helped open for her. She has since centered her career around holding those doors open for those coming up behind her.

After earning undergraduate and master’s degrees in applied mathematics from Harvard University, Dalal, MBA ‘21, started her career in government. She studied how to apply public dollars to impact inequities in sectors like education as a research economist for the White House Council of Economic Advisers. In her current role as vice president for Philanthropy & Impact Advisory at Jasper Ridge, she’s helping build impact investment strategies for high net-worth clients.

“I realized that if government represented the public dollars that we have for social good, philanthropy and impact investing represent the private dollars,” she tells Poets&Quants. “If we’re really going to make progress, we need to get all these pools working together.”

As an MBA at Stanford Graduate School of Business, Dalal spearheaded the launch of the first and only cross-school network of student-managed venture investment funds with a mission to make the world a better place.

The Student Impact Fund Collaborative now boasts a membership of more than 400 students at 15 top business schools in four countries–and growing.

“Our overall mission, while a bit lofty, is about how we mobilize our generation to build a world where businesses and leaders are stewards of social and environmental progress,” she says. “How we actually get there is through these student-led impact funds.”

STUDENT IMPACT FUND COLLABORATIVE

The Student Impact Fund Collaborative officially formed in spring 2021. Then, Dalal was the co-chief investment officer of Stanford GSB’s Impact Fund, the largest of the student-managed impact venture funds (SMIVF). She fielded numerous emails from students at Harvard, Wharton, and other schools wanting to start their own impact venture funds.

Neha Dalal, MBA ’21, now vice president for Philanthropy & Impact Advisory at Jasper Ridge, spearheaded the launch of the Student Impact Fund Collaborative while at Stanford Graduate School of Business.

“I realized that my personal journey was representative of a broader movement that was happening in society–and among young people in general–to prioritize social impact more and more. People were coming to business school with the goal of, ‘How do you make the world a better place?’” she says.

“Impact funds at business schools could really be the focal point. We realized we were having so many one-on-one, unilateral conversations, that we wanted to put it all together and really support each other as a community.”

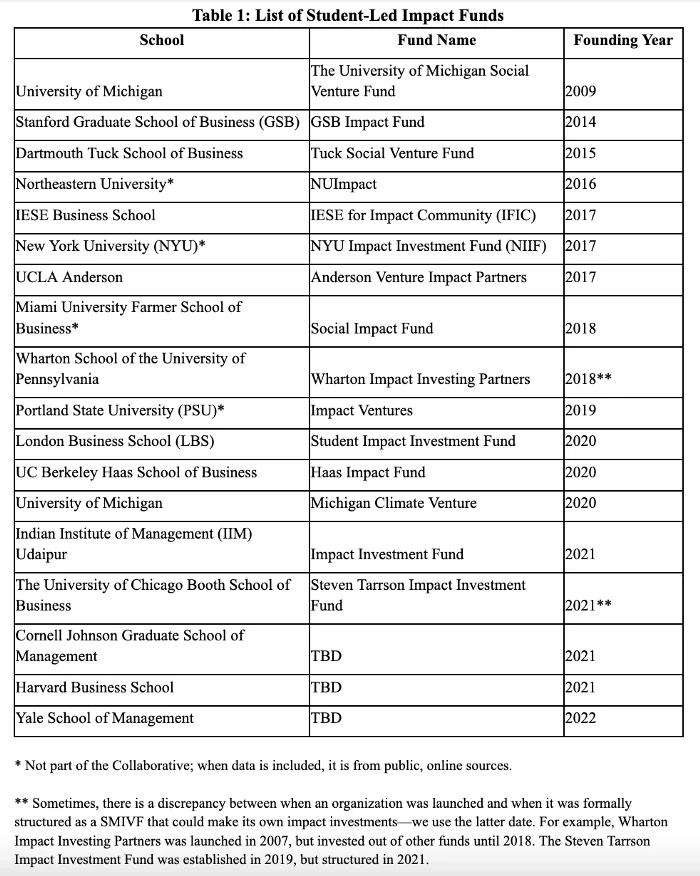

The collaborative now consists of SMIVFs at 15 schools. In the U.S., there’s Stanford GSB, Berkeley Haas, Harvard Business School, Cornell’s Johnson Graduate School of Management, Columbia Business School, Dartmouth Tuck, Duke’s Fuqua, UCLA Anderson School of Management, Chicago Booth, University of Michigan, Wharton School, and Yale School of Management.

International schools include Indian Institute of Management Udaipur, Instituto de Estudios Superiores de la Empresa, and London Business School.

During the 2020-2021 academic year, at least 409 students worked in SMIVFs including 287 MBA students, 68 other graduate students, and 54 undergraduates.

Since graduating in 2021, Dalal now serves as an alumni advisor to the collaborative, working closely with its current co-chairs: Raabia Budhwani, MBA ‘23 at Chicago Booth, and Anny Dow, MBA ‘22 at Stanford GSB.

RISE OF IMPACT INVESTING

As an undergrad, social impact was hardly in the public lexicon and definitely not a hot topic around the halls of business schools, Budhwani tells Poets&Quants. But interest in impact investing is now exploding, both the private sector and within business schools.

Raabia Budhwani, co-chair of the Student Impact Fund Collaborative

Early in 2021, Budhwani was part of a small team of students launching Chicago Booth‘s Steven Tarrson Impact Investment Fund, and they joined the new collaborative to help guide them through the process.

“Personally, I was very interested in building a community of students interested in this emergent sector,” she says. “The Impact Fund Collaborative is important because it enables knowledge sharing and relationship building among these future leaders of the field. Members graduate from their programs with a wide-ranging network of friends, advisors, and partners who’ve been similarly trained in impact finance, ready to collaborate to reshape finance and capitalism to be more world positive.”

This summer, the collaborative released its first report on the landscape of impact investing. It found that funds in the Global Impact Investing Network ballooned to $715 billion in 2019 and, more broadly, some $31 trillion of 2018 investments targeted environmental, social, and governance concerns.

IMPACT FUNDS AT BUSINESS SCHOOLS

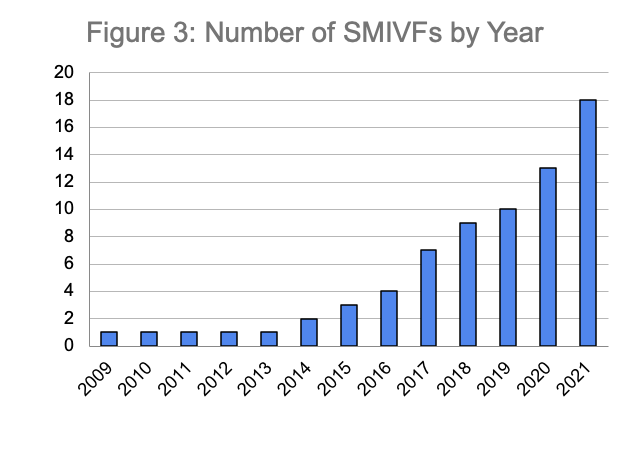

The report also attempted to describe, for the first time, the full landscape of SMIVFs, a topic that has scant published research. It identified 18 different funds operating various business schools, almost doubling in number over the last two years.

The number of school SMIVFs almost doubled from 10 to 18 since 2019. Source: ‘The Student-Managed Impact Venture Fund: An Overview for Students & Others’

Four students at Michigan’s Ross School of Business pioneered the SMIVF model in 2009 by creating the Michigan University’s Social Venture Fund–a response to the 2008 financial crisis and the obvious shortcomings of a “profit-only” mission of business. It was the first such impact fund on a university campus. Over the next decade, other business schools created their own funds including Stanford GSB, Dartmouth Tuck, Northeastern, IESE, NYU, UCLA Anderson, Miami Farmer, UPenn Wharton, and PSU, according to the report.

A list of student-led impact funds by school.

Source: ‘The Student-Managed Impact Venture Fund: An Overview for Students & Others’

“I think it is part of a broader movement in society, and I frankly think a lot of it was accelerated by what has happened in the last couple of years.

“Not just the pandemic, but Back Lives Matter in the United States, and the worsening climate crisis. It has forced people to reckon for the first time with the fact that our actions impact the world around us,” Dalal says. “When you’re spending so much of your life and so much of your time and so much of your mental bandwidth on work, your work should hopefully be helping push the world in the direction that you want it to go.”

‘THOUSANDS OF FUTURE INVESTORS, ENTREPRENEURS & LEADERS’

The collaborative is organized around four operational pillars: Community building, which was mostly virtual through the pandemic, but it is looking for more in-person connections in the coming year; sharing deal flow models within the different schools and funds; practical learning through workshops and other means to help new schools start funds; and mobilization around the funds more broadly.

Anny Dow, co-chair of the Student Impact Fund Collaborative

One of Dow’s goals going into business school was learning to build and scale impactful social enterprises, and that led her to join the Stanford GSB Impact Fund in her first year. She became the fund’s director of portfolio operations in her second year. The collaborative was a logical extension.

“I was drawn to the Collab’s mission of unifying and amplifying the efforts of student-led impact funds seeking to shape the growing impact investing discipline – allowing each fund to better select and support ventures that will go on to create educational opportunities for people around the world, improve environmental outcomes, provide better quality and access to healthcare, and much more,” she tells Poets&Quants.

“As thousands of future investors, entrepreneurs, and leaders are getting their first exposure to impact investing and entrepreneurship through student-led funds, it’s important to have forums for students to share knowledge as we help shape this evolving space.

“The Collab is uniquely positioned to bring together students across funds … to maximize impact toward solving some of the most complex challenges around the world.”

WHAT COMES NEXT

As the collaborative steps into its second year, its leaders hope to help launch more student-managed impact funds, expand its platform and resources, and continue to build its community of members and schools.

“As the collaborative grows and gains wider acclaim after its formative years, my hope is that it becomes a leading voice at the table for developing investing and social enterprise talent. I’d like to see investment firms partnering with the Impact Fund Collaborative to source talent, seek insights, and source deals,” Budhwani tells P&Q.

“I also look forward to seeing student members graduate and go on to change the world of finance and impact, and can’t wait to be a part of that alumni network.”

Dalal notes that the collaborative is also a great platform for alumni to really get involved and support the generation coming behind them, whether acting in an advisory role to the funds themselves or through financial contributions to help establish new ones.

“Almost every one of these funds has had broad alumni support, and that’s the only reason they’ve been possible,” she says. “I think it has to be a whole community effort, hopefully, not just the current iteration of students.”

Read the collaborative’s full report, “The Student-Managed Impact Venture Fund: An Overview for Students & Others.” Or connect with the fund directly at impactfundcollab@gmail.com.

DON’T MISS: MICHIGAN ROSS’ NEW EQUITY ANALYTICS COURSE STRESSES DATA WITH IMPACT AND HOW NORTHWESTERN KELLOGG BECAME A SOCIAL IMPACT HUB

© Copyright 2025 Poets & Quants. All rights reserved. This article may not be republished, rewritten or otherwise distributed without written permission. To reprint or license this article or any content from Poets & Quants, please submit your request HERE.