Next month, the UC Irvine Paul Merage School of Business will launch a free online course to teach young people how to manage their finances and make career decisions wisely.

Peter Navarro, a UC Irvine economics professor, will teach the five-week Massive Open Online Course (MOOC) from Aug. 4 to Sept. 8. The class, titled “Managing Your Time, Money, and Career: MBA Insights for Undergraduates,” is structured around 10 video lectures and will be co-taught by Navarro’s stepson, Alex LeBon, an undergraduate student about to enter his junior at Rensselaer Polytechnic Institute.

“I think it’s going to be really valuable for people who are either undergraduates or in high school getting ready to go to college, or even people who simply haven’t figured out how to manage their life yet,” Navarro says.

When he was asked to build a set of courses to deal with these issues, Navarro’s first thought was that someone else must have done it already. “But there are just no courses out there that teach young people the rudiments of handling money. It really took me aback. You can find plenty of stuff out there on the Internet for specific topics, but there’s nobody who bundles all of it into a coherent course. It’s really astonishing colleges don’t do that.”

So far, there are approximately 430 students enrolled in the for-credit course at UC Irvine, and about 30,000 enrolled through Coursera, the educational technology company that offers MOOCs.

Navarro’s target group is freshmen and sophomores in college, but he says to think of the student demographic as a bell curve. “The top of the bell curve is going to be freshmen, but there are also high school seniors and many college juniors and seniors and college graduates who can still benefit from the course.”

In an effort to connect with a younger audience, Navarro’s co-teacher LeBon is the primary teaching voice in the video lectures. “The idea is that seeing him on camera and hearing him will reach other college undergraduates better than hearing a guy like me,” Navarro says.

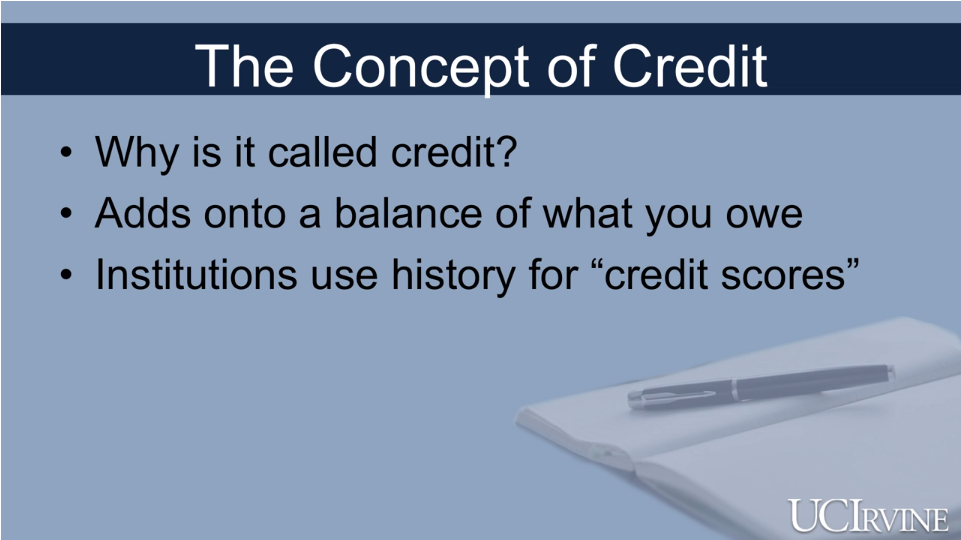

The video lectures alternate between a conversation with the two instructors and LeBon lecturing over slides, images, and video clips. They work their way through a number of topics like saving and investing money, insurance, and taxes. One of the lessons also includes a discussion about how to be an entrepreneur. Navarro and LeBon bring in guest speaker Greg Autry, a lecturer at the Center for Entrepreneurship at the University of Southern California, and Navarro says it summarizes what the best MBAs know.

Navarro and LeBon use images, like this credit card application, to demonstrate what they are teaching

Though LeBon says he originally agreed to help out because he figured it would be a decent summer job with flexible hours, he’s learned a lot through the process, which surprised him.

“Going into it, I thought I knew a lot already because I live with an economics professor. But there’s quite a bit about insurance and investments and different ways to structure your budget that was new to me.”

LeBon says that he probably learned the most concerning credit cards. “We spend two of the lessons talking about credit cards, debit cards, and credit scores, and one of the things we teach people is that as they get older they might want to get a mortgage or something, and it’s a lot easier if they’ve already established credit and are building a good credit score. A lot of people, especially people my age, see credit cards as extremely bad things, but if we take on some responsibility, it can be good. I was on the boat of ‘all that is credit cards is bad,’ and it wasn’t until working on this that I realized it’s an important part of a good financial plan.”

LeBon also said that among his peers in college, he sees a lot of people with bad budgets, people who are taking on huge student loans but don’t know about different ways to refinance them or ways that they can structure their payments. Others are irresponsibly using credit cards, or not using credit cards at all, which he says is almost as bad a mistake.

“I think that students like me can get a lot from this course, and it would definitely improve things for them.”

The videos are each 15 to 20 minutes long, segmented into three parts, and are followed by quizzes and exercises for the students. Navarro says that one of his biggest problems with online courses is that some of them are just hyperlinks to assigned readings, and others have bad audio or other technical problems.

“The way we make these videos is all done under my supervision,” he says. “Alex and I record the script, and then it’s a video editing process. These things look really nice – they’re high definition experiences that people should really enjoy.”

Navarro has quite a bit of experience, both with online teaching and also in film. He teaches two other MOOCs, “The Power of Microeconomics: Economic Principles in the Real World,” and “The Power of Macroeconomics: Economic Principles in the Real World.” He also makes films, including “Death By China,” a documentary based on his book by the same name that runs on Netflix.

“I use my filmmaking experience to really make this look nice,” he says. “I expect that over the next couple years we’ll have hundreds of thousands of people taking this course.”

“The main theme of the course is just having a good plan for your money,” LeBon says. “We just try to arm students with as much information and advice as we can.”

Questions about this article? Email us or leave a comment below.