Source: U.S. Census Bureau and U.S. Bureau of Labor Statistics, Current Population Survey, March Supplement; U.S. Bureau of Labor Statistics, consumer price index.

Tuition costs have been rising, and wages for college-educated workers have been stagnant for over a decade. But a recent study by the New York Federal Reserve found that investing in a college degree is still the best thing a high school graduate can do for his or her finances, and majoring in business is one of the surest ways to keep a hefty tuition bill from going to waste.

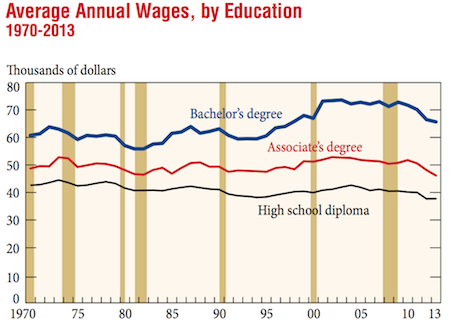

“Indeed, once the full set of costs and benefits is taken into account, investing in a college education still appears to be a wise economic decision for the average person, conclude authors Jaison R. Abel and Richard Deitz in a paper published on June 24, 2014. “Why is this the case? The answer lies in the declining fortunes of those without a college degree.”

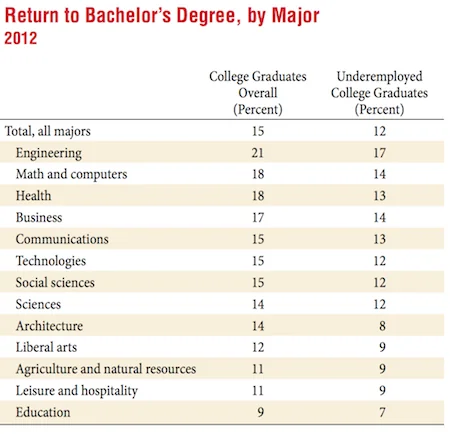

The college wage premium is near an all-time high, largely because wages for those without degrees are falling. The study found that college is a good investment across the board, with graduates averaging a 15% return to college regardless of their field. Not surprisingly, rates of return vary considerably among majors. Business ranked as the fourth best major to invest in, with a hefty 17% ROI for employed graduates.

To put that in perspective, the study compared investing in college to investing in stocks and bonds. Investing in stocks has had an annual return of 7%, and investing in bonds has yielded 3% since 1950. Even the lowest return for a college degree – 9% for students who graduate as education majors – beats the returns on both stocks and bonds.

ENGINEERING MAJORS TOP THE LIST WITH 21% RETURNS

Source: U.S. Census Bureau, American Community Survey; U.S. Department of Labor, O*NET; U.S. Department of Education, Digest of Education Statistics 2012; The College Board, Trends in College Pricing 2013 and Trends in Student Aid 2013.

One of the largest concerns over tuition costs, however, is that students are not always able to find suitable employment after they graduate. The New York Federal Reserve’s own research suggests that around one-third of those who graduate from college spend much of their careers in jobs that do not require a bachelor’s degree. The study on college returns, however, showed that underemployed college graduates still see a 12% ROI. Additionally, underemployed graduates with business degrees actually see a 14% ROI. “While people in these non-college jobs receive lower returns than their counterparts working in jobs that require a bachelor’s degree, they still tend to earn a relatively high positive return,” Abel and Deitz wrote.

In calculating the benefits of a degree for underemployed workers, the study measured the extra wages earned beyond the wages of a high school graduate, and simulated lifetime earnings for the average worker who remains underemployed for his or her entire career. As most underemployed graduates will work their way up into college-level jobs, one can assume that the return to college for the underemployed may be more optimistic than reported.

The study concludes by summing up the good and the bad news – that the return to college remains high for all graduates, and that it is not necessarily high because graduates earn a lot, because they would earn significantly less without their degrees. “Investing in a college degree may be more important than ever before because those who fail to do so are falling further and further behind,” they said.