Source: Wall Street Oasis 2022 Investment Banking Industry Report

WHICH INVESTMENT BANKS HAVE THE BEST WORK-LIFE BALANCE?

About 10 years ago, when there was a rash of high-profile deaths of investment banking interns who’d worked multiple all-nighters in a row. Many of the larger banks instituted policies that required workers to take at least some time off each week, or each month at the very least, Curtis says.

Then, little by little, banks became a bit more lax about those policies. The market got hot and COVID hit and everyone went to work from home. Bankers could work even longer hours without grabbing too much attention and managers were happy to let them.

“The banks were exploding with deal volume and there were billions of dollars at stake,” Curtis says. “I think MDs thought, ‘Well, I suffered when I was an analyst and we can clost on this $20 million revenue if we just work hard. COVID just exacerbated it because things became more impersonal, and it was more lonely for the analysts. One of the best parts of the analyst program is that even though you’re working crazy hours, you had that camaraderie in the bullpen. That doesn’t happen when you’re alone in your room or you’re working in your parents’ house.”

Because WSO’s industry reports are based on year-to-date data plus the two previous years, these work-life balance metrics largely cover the first two years of the pandemic. And, the average hours worked reflected the work-from-home rush.

In fact, in this year’s report, employees at two companies – Itau BBA and Morgan Stanley – reported working an average of 90 hours per week. Goldman Sachs employees reported working 87.5 hours per week. In all, employees at 20 banks reported working 80 or more hours per week. (In 2019, the year before the pandemic sent most employees to their home offices, the most reported hours per week was 88.8 at BTG Pactual, followed by 88.3 at Miller Buckfire, and 87.5 at Agentis Capital.)

If you’re an aspiring banker but would like a little more balance in your career and personal pursuits, WSO’s report has several employee-reported metrics surrounding lifestyle. You’ll notice that some of the top-paying firms don’t necessarily score particularly high in these metrics. That’s the tradeoff aspiring investment bankers have to make: An astronomical salary or a manageable workload.

- Hours Worked Per Week (see chart top left): After Itau, Morgan Stanley and Goldman Sachs, three companies averaged 85 hours per week. These were Arma Partner, Financiere Cambon, and Stephens. Brown Gibbons Lang and Company averaged 83 hours, while ™ Capital and ABG Sundal Collier averaged 82.5 hours per week.

- Worst Work/Life Balance (see top right): Companies that employees ranked worst for work/life balance included Ducera (up one spot from last year with a 99.5 percentile) and Roth Capital Partners (99%). Three companies appeared in the worst five for the first time: Itau BBA (also worst in hours worked per week), Crosstree Capital Partners and Intrepid Investment Bankers. Arma Partners rose seven places in the worst balance list, ranking No. 6 with a 97.1 percentile.

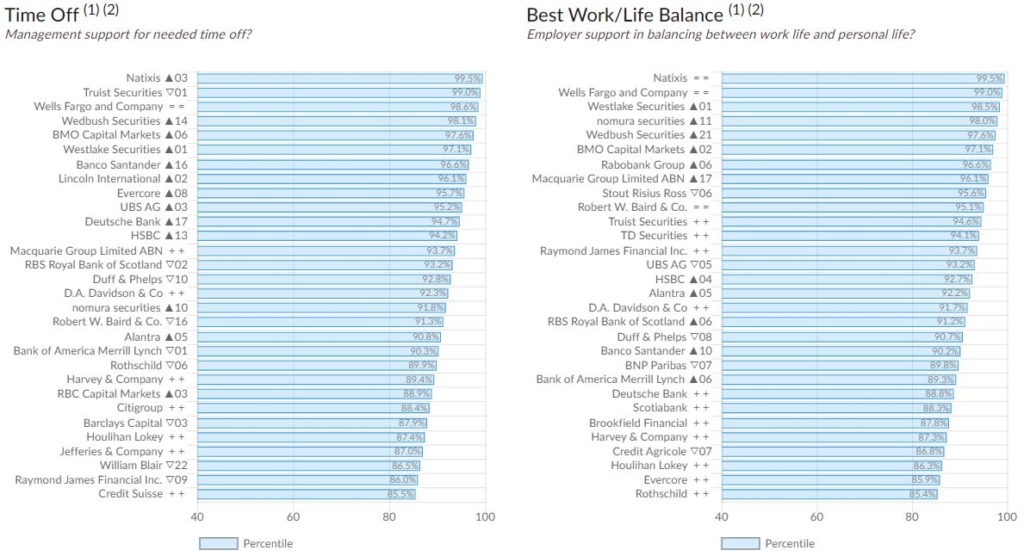

- Management Supports Needed Time Off (see chart bottom left): At the other end of the spectrum, the companies most likely to support an employee’s request for needed time off were Natixis, up three from last year with 99.5 percentile. They were followed by Truist Securities (99%) Wells Fargo (98.6%) Wedbush Securities (which rose 14 spots) and BMO Capital Markets (97.6%).

- Best Work/Life Balance (see top right): Not surprisingly, most of the companies that employees say are supportive of time off also offer the best work/life balance. They are Natixis, Wells Fargo, Westlake Securities, Nomura Securities (up 11 spots from last year) and Wedbush Securities (up 21 spots.)

Source: Wall Street Oasis 2022 Investment Banking Industry Report

DON’T MISS: DATA: COLLEGE BOARD FINDS HISTORICALLY LOW INCREASES IN TUITION and WHICH UNDERGRAD B-SCHOOLS REQUIRE COVID SHOTS & BOOSTERS IN 2022?

Questions about this article? Email us or leave a comment below.