For the previous two or three generations, college was basically a guarantee of upward socioeconomic mobility. Nowadays? It’s complicated, says a new study from researchers at the Federal Reserve Bank of St. Louis.

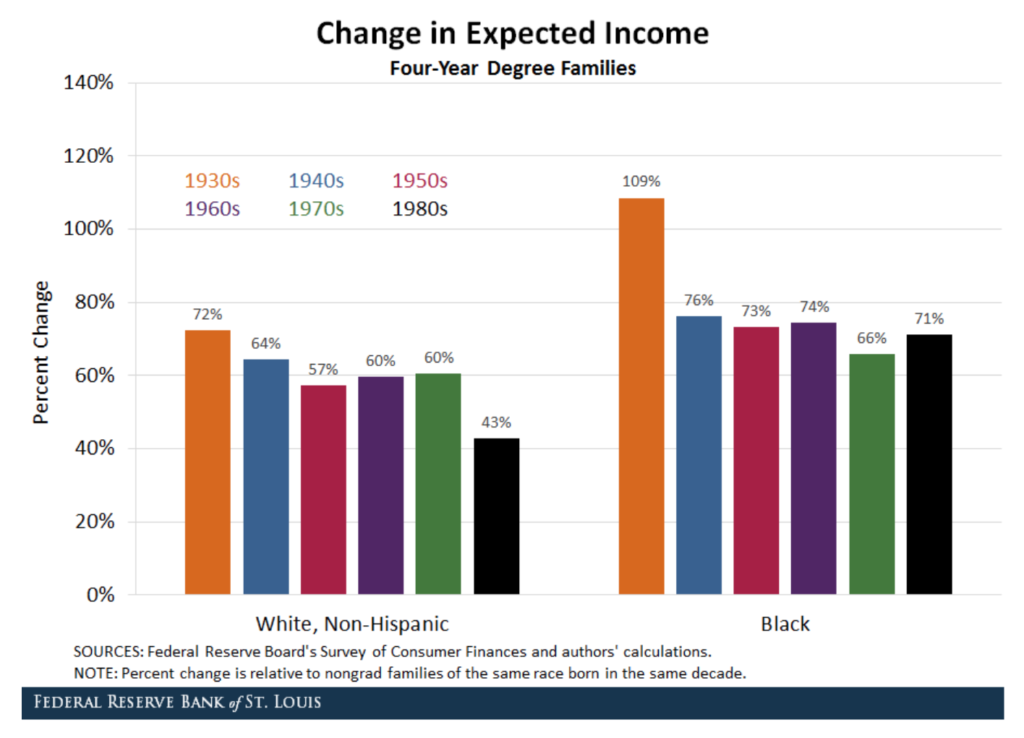

The researchers examined wealth and income among college graduates and post-graduate degree holders from the 1930s to 1989 and found two main trends. First, the average income generated by families with four-year degree holders has dropped fairly substantially, though it remains significantly higher than families with no college degree holders.

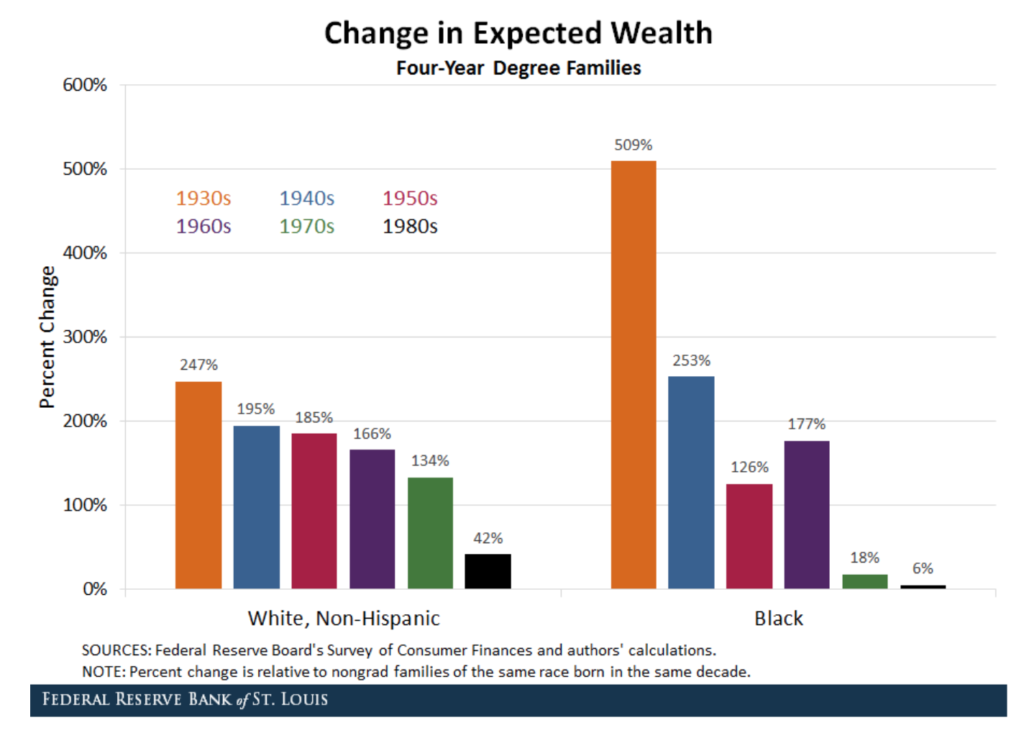

Second, and more concerning: Expected wealth among families with college degrees has declined dramatically — especially for minorities.

Graph from the “Is College Still Worth It? It’s Complicated” report

“In terms of earnings, college is clearly still worth it,” reads the report, Is College Still Worth It? It’s Complicated. “This was true for all races and ethnicities, including non-Hispanic white, black, Hispanic of any race and all other families.”

But hold on. As indicated above, wealth accumulation is a different — and more disturbing — story. “In terms of wealth accumulation, college is not paying off for recent college graduates on average — at least, not yet,” the report says.

From the “Is College Worth It? It’s Complicated” report

SEA CHANGE IN THE LAST TWO DECADES

As you can see, a college degree led to massive wealth accumulations for those born in the 1930s through the 1960s, despite a general trend of less accumulation of wealth overall. For babies born in the 1980s, however, wealth accumulations are a bit more gloomy. The researchers from the Federal Reserve Bank pose three potential explanations for why wealth accumulation has dramatically deteriorated while income has remained relatively the same.

The first and obvious explanation is the rising costs of college. Over the past decade or two — when people born in the 1980s would’ve attended college — tuition has sky-rocketed across public and private colleges. It’s no secret young adults are graduating with more college debt than ever before. Which segues to the researchers’ next explanation — the greater availability and risk of consumer debt. Not just student loan debt, but credit card debt, and car and house loans are more pervasive than ever before. Lastly, the researchers say luck in terms of investing could be an explanation. The markets are seemingly more volatile than ever and the Great Recession didn’t help matters.

“On average — that is, across all birth years, races and ethnicities — college is still worth it in terms of earnings. We found that college and postgrad degree holders generally earn significantly higher incomes than nongrads,” the report reads.

“However, for recent generations and for non-white students, the payoffs are somewhat lower than average. This is especially true for wealth accumulation. Considering all of the evidence, we conclude that the conventional wisdom about college is not as true as it used to be.”

One way to potentially offset these findings is to major in a lucrative field like engineering or business. Graduating from a top business school these days almost guarantees a relatively high salary immediately after graduation. Of the 88 business schools ranked this past year by Poets&Quants, 2018 graduates from all but 15 schools reported earning more on average in their first jobs after graduation than the national average salary of about $50,000 across all majors. According to those salaries and the cost of attending the top schools in our ranking, the business degree still has a salty return on investment.

DON’T MISS: BEST BUSINESS SCHOOLS FOR LANDING A JOB RIGHT OUT OF OF SCHOOL or SCHOOLS THAT GET YOU THE JOB YOU REALLY WANT

Questions about this article? Email us or leave a comment below.